Plastic Market Size, Share & Trends Anal

2023-05-19 16:39Report Overview

The global plastic market size was valued at USD 593.00 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030. The increasing plastic consumption in the construction, automotive, and electrical & electronics industries is projected to support market growth during the forecast period. Regulations to decrease gross vehicle weight to improve fuel efficiency and eventually reduce carbon emissions are driving plastic consumption as a substitute for metals, including aluminum and steel, for manufacturing automotive components.

To learn more about this report, request a free sample copy

The growth of the construction industry in emerging markets such as Brazil, China, India, and Mexico has been instrumental in fueling the demand for plastics. The progress of the overall market can be attributed to increased foreign investment in these domestic construction markets, as a result of easing FDI norms and requirements for better public and industrial infrastructure.

The plastics market demand in the U.S. was valued at USD 86.02 billion in 2021. The high market share of the country is attributed to the presence of the well-established automotive, aerospace & defense, and electronics industries. The country is characterized by a low-risk environment, a stable economy, and a robust financial sector. These factors have provided a multitude of opportunities for investors in recent years, which are likely to trigger infrastructure spending in the country. This, in turn, is projected to positively impact the demand for plastics in the U.S. construction industry.

The growing population, coupled with rapid urbanization and industrialization in emerging economies, has been impelling federal governments to increase their construction spending to cater to increasing infrastructure needs. Rising construction spending by governments, particularly in China and India, will drive the demand for plastic in infrastructure and construction applications.

Stringent regulations regarding depletion and recyclability of conventional materials such as metal and wood are anticipated to drive greater plastic demand from construction industries in insulation, pipes, cables, floorings, windows, storage tanks, and others. Polymer fittings are also generally quite simple and easy to install, compared to metals or wood, with a wide range of color combinations adding to their aesthetic appeal.

Plastic has 85% less specific gravity compared to metals. When used in the automotive and construction industries, they enable approximately 80% weight savings and 30% to 50% cost savings in individual components. The increasing incidences of positive cases of COVID-19 across the globe due to new virus variants are positively influencing the demand for plastic in medical devices such as testing equipment, ventilators, gloves, syringes, surgical trays, and medical bags.

Product Insights

Polyethylene held the largest market revenue share of more than 25.0% of the overall demand in 2021. It is primarily used in the packaging sector, which includes containers and bottles, plastic bags, plastic films, and geomembranes. Based on its molecular weight, there are different types of polymers of PE such as HDPE, LDPE, and LLDPE. For instance, low molecular weight polymers of PE find use in lubricants; medium molecular weight polymers are used as wax, miscible with paraffin; high molecular weight polymers are commonly used in the plastic industry.

Rising demand for packaged food, trays, bottles for milk and fruit juices, crates, caps for food packaging, drums, and other liquid food packaging, to combat the spread of COVID-19 across the world is expected to drive the demand for polyethylene in the coming years.

Acrylonitrile butadiene styrene (ABS) is one of the promising product segments in the plastic market. ABS is widely used in consumer goods and electrical & electronics applications and is gaining popularity owing to its excellent rigidity, high strength, and dimensional stability. It is a tough material and is resistant to corrosive chemicals, physical impact, and heat. Thermoplastics such as ABS liquefy, allowing them to be easily injection molded and recycled. However, ABS is not used in high-heat situations because of its low melting point.

LEGO toys and computer keyboards are also significant application areas for ABS compounds. ABS is also used in manufacturing drain-waste-vent pipe systems, plastic clarinets, golf club heads, musical instruments, enclosures for electrical & electronic assemblies, automotive trim components, and protective headgears, among various other products.

Report Coverage & Deliverables

Application Insights

The injection molding application segment held the largest revenue share of over 43.0% of the overall demand in 2021. Injection molding is a common method for producing custom plastic parts. It is a discontinuous process as the plastic parts are produced in molds and are required to be cooled before being removed. This process requires an injection molding machine, molds, and plastic materials. The molten plastic is injected into a mold cavity and then cooled to create the final product. It is generally used in the production of automobile parts, containers, and medical devices among others.

Calendering is one of the potential application segments in the plastics market. It is used to process thermoplastic materials into films and sheeting. It is mainly used for PVC as well as certain other modified thermoplastics. The process consists of five steps - pre-blending, fluxing, calendering, cooling, and winding-up. It allows specialty surface treatments of films or sheets such as enhancing or embossing the physical properties or in-line lamination. The growing packaging industry is driving the demand for films and sheets which, in turn, is further creating the demand for calendering.

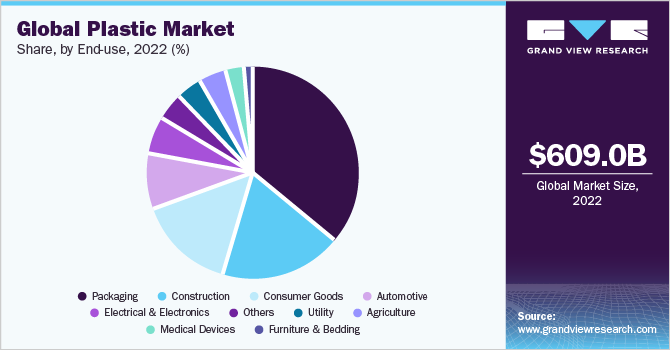

End-use Insights

The packaging end-use segment held the largest market revenue share of more than 36.0% of the overall demand in 2021. Packaging is a high-potential end-use segment with moderate penetration. Plastic has been an integral part of the packaging industry. Furthermore, the advent of bio-based plastics has also played a significant role in the food, pharmaceutical, and beverage packaging sectors.

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

Plastics such as Polyethylene Terephthalate (PET) and Polycarbonates (PC) are increasingly being used in the packaging of beverages, consumer goods, appliances, toys, and apparel. The packaging of appliances is expected to offer lucrative opportunities for market growth. The demand for packaging for healthcare products, groceries, and e-commerce transportation has increased sharply in the post-COVID period, while the demand for luxury, industrial, and some B2B transport packaging declined, owing to the suspension or slowdown of industrial production.

Moreover, the demand for plastic in consumer packaging is expected to shift drastically towards food packaging, owing to the shutdown of restaurants and foodservice outlets during the pandemic. The stockpile and panic purchases of food, groceries, and other homecare necessities are further expected to boost the aforementioned trend.

Regional Insights

Asia Pacific (including China) dominated the plastics market and accounted for over 44.0% share of the global revenue in 2021. The rapidly-growing manufacturing sector is expected to propel the demand for plastic in the automotive, construction, packaging, and electrical & electronics industries. In the recent past, India and China have witnessed a spike in automotive production owing to technology transfer to the sector from the Western markets.

In addition, a well-established manufacturing base for electrical & electronics in Taiwan, China, and South Korea is anticipated to provide further impetus to the plastic industry. India has a strong chemical manufacturing industry base, which serves to strengthen its plastic production. Rapid urbanization, improving economic conditions, and increasing infrastructural activities are the factors supporting the growth of the market for plastics in the Asia Pacific.

China is the largest supplier and producer of plastic components in this region. The growth of the automotive and electronic markets and the subsequent demand for lightweight components to improve the efficiency of vehicles and reduce the weight of electronics components are the major factors contributing to the higher demand for plastic in the country.

Key Companies & Market Share Insights

The competitive rivalry among producers is high, owing to the presence of several players in the market. The global market is highly fragmented in nature with the presence of various key players, as well as a few medium and small regional players operating in different parts of the world. Strategic partnerships, capacity expansions, and new product developments are popular strategies adopted by a majority of the players operating in the overall plastics market. Some prominent players in the global plastic market include:

-

BASF SE

-

SABIC

-

Dow Inc

-

DuPont de Nemours, Inc

-

Evonik Industries

-

Sumitomo Chemical Co., Ltd.

-

Arkema

-

Celanese Corporation

-

Eastman Chemical Company

-

Chevron Phillips Chemical Co., LLC

-

Lotte Chemical Corporation

-

Exxon Mobil Corporation

-

Formosa Plastic Corporation

-

Covestro AG

-

Toray Industries, Inc.

-

Mitsui & Co. Plastic Ltd.

Plastic Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 609.01 billion |

|

Revenue forecast in 2030 |

USD 811.57 billion |

|

Growth Rate |

CAGR of 3.7% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2019 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2022 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; China; Asia Pacific excluding China; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Poland; India; Japan; Southeast Asia; Brazil; Argentina; Colombia; Chile; Other CSA; Saudi Arabia; United Arab Emirates (UAE); Oman; Kenya; South Africa |

|

Key companies profiled |

BASF SE; SABIC; Dow Inc; DuPont de Nemours Inc.; Evonik Industries; Sumitomo Chemical Co., Ltd.; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co. LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastic Corporation; Covestro AG; Toray Industries, Inc.; Mitsui & Co. Plastic Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope report, we will provide it to you as a part of customization |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global plastic market report on the basis of product, application, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl chloride (PVC)

-

Polyethylene terephthalate (PET)

-

Polystyrene (PS)

-

Acrylonitrile butadiene styrene (ABS)

-

Polybutylene terephthalate (PBT)

-

Polyphenylene Oxide (PPO)

-

Epoxy Polymers

-

Liquid Crystal Polymers

-

Polyether ether ketone (PEEK)

-

Polycarbonate (PC)

-

Polyamide (PA)

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Injection Molding

-

Blow Molding

-

Roto Molding

-

Compression Molding

-

Casting

-

Thermoforming

-

Extrusion

-

Calendering

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Packaging

-

Construction

-

Electrical & Electronics

-

Automotive

-

Medical Devices

-

Agriculture

-

Furniture & Bedding

-

Consumer Goods

-

Utility

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Poland

-

Spain

-

-

China

-

Asia Pacific (excluding China)

-

India

-

Japan

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Other CSA (Costa Rica, Cuba, Peru)

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

Oman

-

Kenya

-

South Africa

-

-